Presenting a Model for Determining Key Performance Indicators of the Insurance Industry on the Development of the Entrepreneurial Ecosystem Using the Panel Data Approach in Selected Countries (2010-2020)

Keywords:

Key performance indicators of the insurance industry, entrepreneurial ecosystem development, selected countries, panel dataAbstract

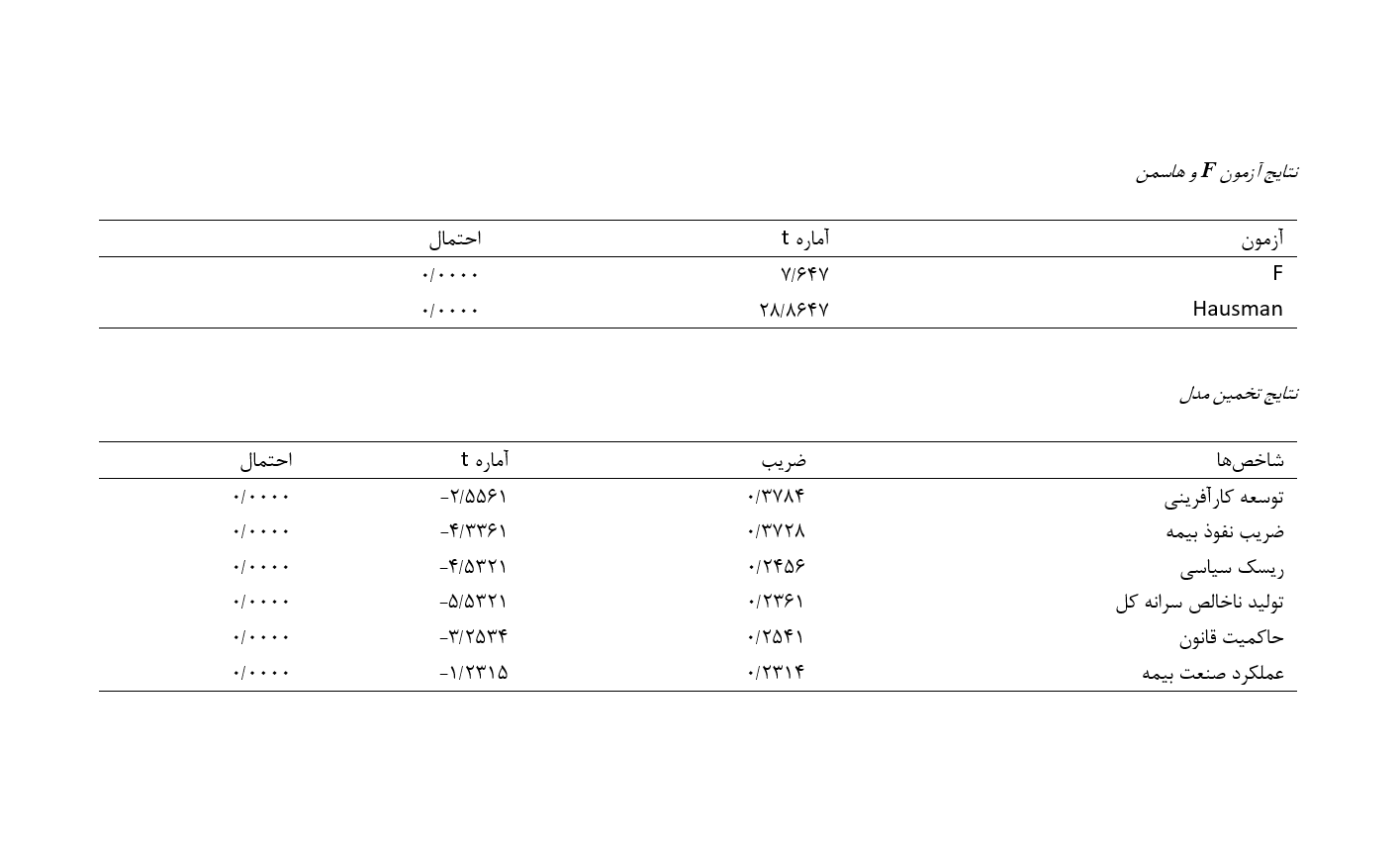

The objective of the present article is to propose a model for determining the key performance indicators (KPIs) of the insurance industry on the development of the entrepreneurial ecosystem using the panel data approach in selected countries during the period from 2010 to 2020. The statistical population of this study includes selected countries (the Philippines, Iran, Kazakhstan, South Africa, Hungary, Sweden, Poland, Peru, Mexico, Argentina, Brazil, Colombia, Malaysia, Australia, Thailand, Croatia, the United States, the United Kingdom, and Norway), utilizing the panel data method. For this purpose, data related to the selected countries over the 2010-2020 period were employed, using the panel data approach. Eviews version 21 software was used for data analysis. The analysis results indicated a significant correlation between the performance of the insurance industry and the variables of entrepreneurial development, insurance penetration rate, political risk, gross domestic product per capita, and the rule of law. The Levin, Lin, and Chu test was used to measure the reliability of the indicators. The results showed that all the examined indicators are reliable. The results of the co-integration test revealed a strong long-term relationship between the variables used. The estimated coefficient of the model for the variables—entrepreneurial development, insurance penetration rate, political risk, gross domestic product per capita, the rule of law, and insurance industry performance—are -0.3784, -0.3728, -0.2456, -0.2361, -0.2541, and 0.2314, respectively. For instance, the estimated coefficient for gross domestic product (GDP) per capita is -0.2361, indicating that a 1% increase (or decrease) in GDP per capita results in a 0.2361% decrease (or increase) in the insurance industry's performance indicator.

Downloads