Designing a Model for National Banks’ Support to Foster Entrepreneurial Behavior in Small and Medium-Sized Enterprises

Keywords:

banking industry support, entrepreneurial behavior, small and medium-sized enterprises, mixed approachAbstract

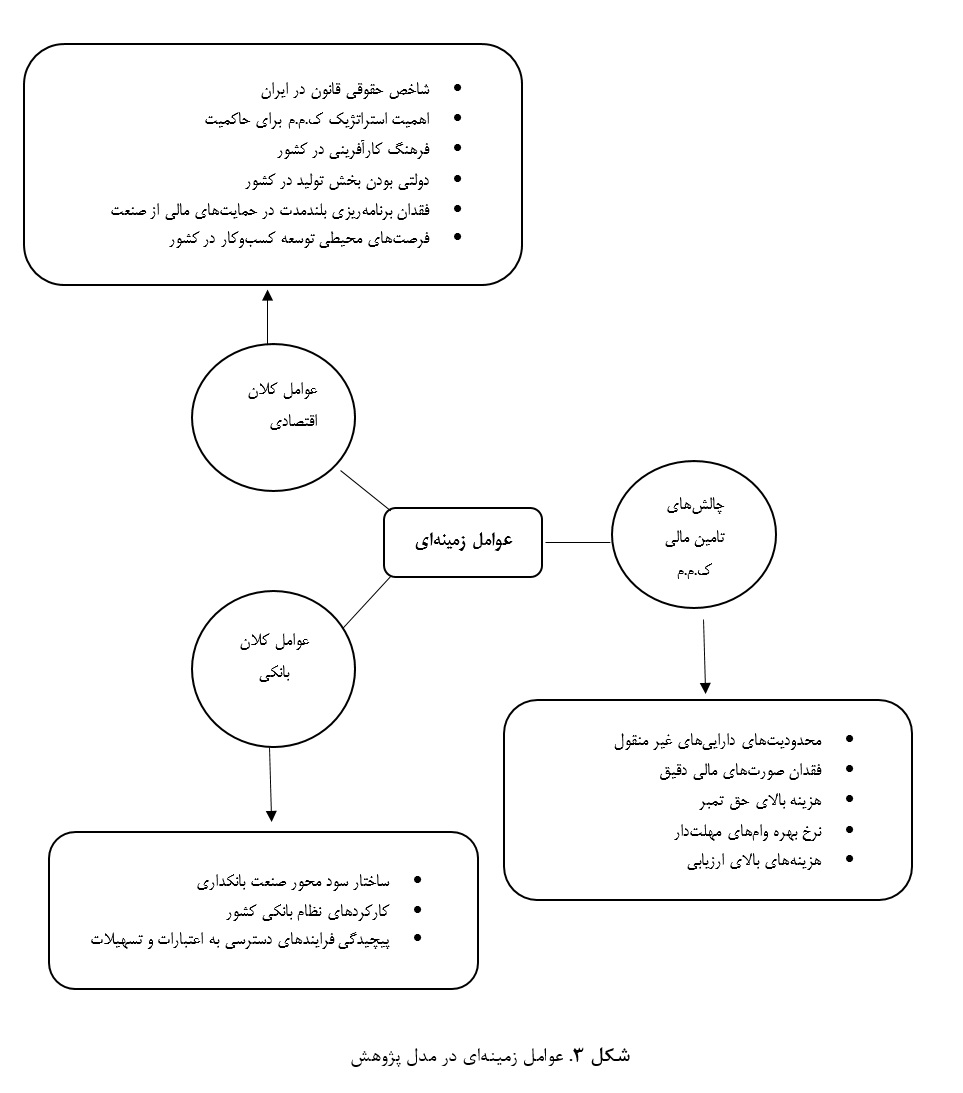

Small and medium-sized enterprises (SMEs) are considered the main drivers of economic development, and financial and technical support for them can have significant impacts on overall economic flows. Banks, as the primary arm for financing and credit provision to businesses, play an indispensable role in this regard. Thus, the primary objective of this study is twofold: first, to propose a model for national banks’ support aimed at fostering entrepreneurial behavior in SMEs, and second, to examine the significance and prioritization of key factors influencing banks' supportive role in developing entrepreneurial behavior in SMEs. To achieve this, the study utilized expert opinions from a panel of seven specialists in economics and banking from West Azerbaijan province for the qualitative section, and 464 managers from banks (specifically Sepah Bank) and SMEs in the province for the quantitative section. Data collection tools included semi-structured interviews for the qualitative phase and a researcher-made questionnaire for the quantitative phase. For data analysis and identifying influencing factors regarding banks' support for the development of entrepreneurial behavior in SMEs, thematic analysis and MAXQDA software were employed. Additionally, quantitative data analysis was conducted using structural equation modeling and AMOS software. The qualitative findings revealed that a total of 82 primary themes, organized into 14 organizing themes, can be identified in the context of banks' role in supporting the development of entrepreneurial behavior in SMEs. In the quantitative section, the significance and prioritization of causal, intervening, and contextual factors were examined. The results also demonstrated how the entrepreneurial behaviors of SMEs can either advance or stagnate based on banks' behaviors.

Downloads