The Performance of Momentum and Reversal Strategies Under Conditions of Financial Stress and No Financial Stress

Keywords:

financial stress, strategy, momentum, reversalAbstract

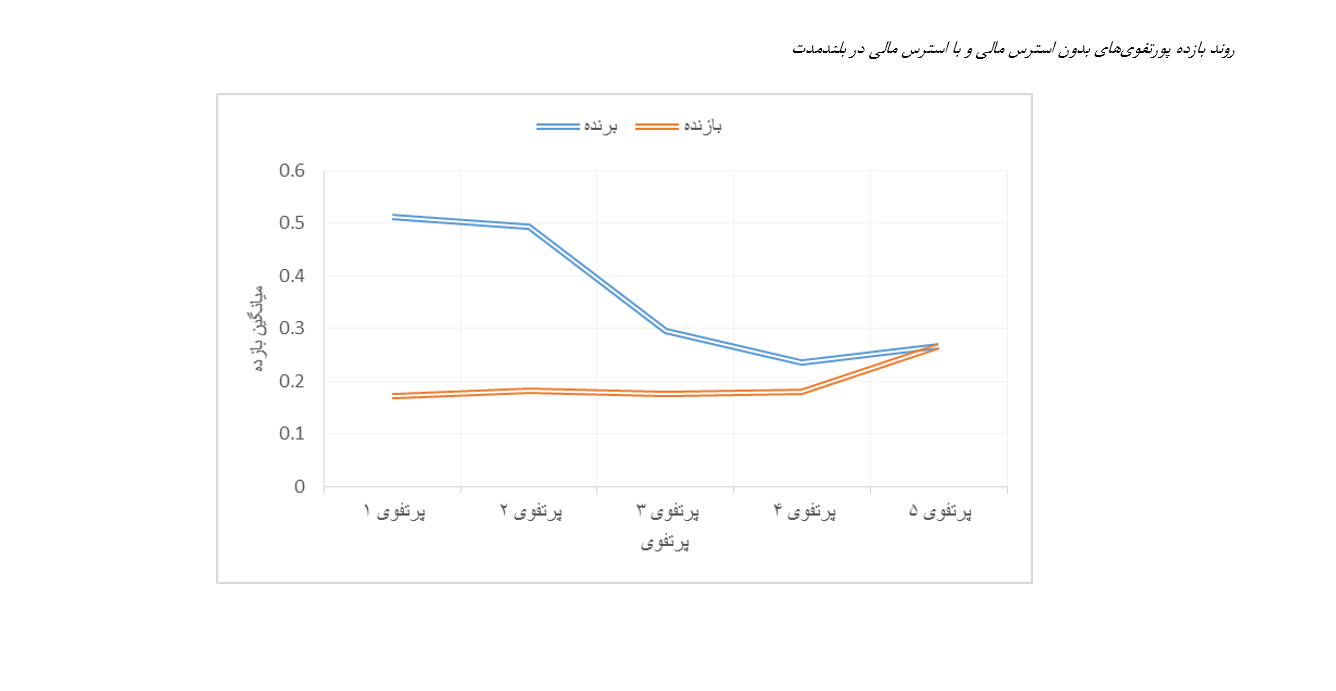

In the financial market, two key indicators, risk and return, play a determining role in the investment decisions of various companies. Investors seek to choose options that offer maximum returns with minimal risk, and they aim to apply strategies to achieve excess returns and outperform the market. One of the important and widely used strategies among investors for selecting an optimal portfolio in financial markets is the momentum strategy. Therefore, the present study investigates the performance of momentum and reversal strategies under conditions of financial stress and no financial stress. In this regard, to compare the performance of the momentum strategy under conditions of no financial stress in both the short and long term, a paired t-test was used. The statistical hypothesis related to this part showed that if the cumulative abnormal return for the arbitrage portfolio is positive, purchasing stocks without financial stress in the short term and selling stocks without financial stress in the long term can generate positive abnormal returns. The results of the hypothesis testing showed that in all cases, except for the fifth portfolio, the significance level was smaller than the test level. In other words, for the first, third, and fourth portfolios, it can be claimed with high confidence that using the momentum strategy and purchasing stocks without financial stress in the short term and selling stocks without financial stress in the long term can generate positive returns. On the other hand, for the second portfolio, it can be claimed that using the momentum strategy and selling stocks without financial stress in the short term and purchasing stocks without financial stress in the long term can generate positive returns.

Downloads