Analysis of Financial Risk Management Model in Knowledge-Based Startup Companies

Keywords:

Startup companies, knowledge-based, risk management, financial riskAbstract

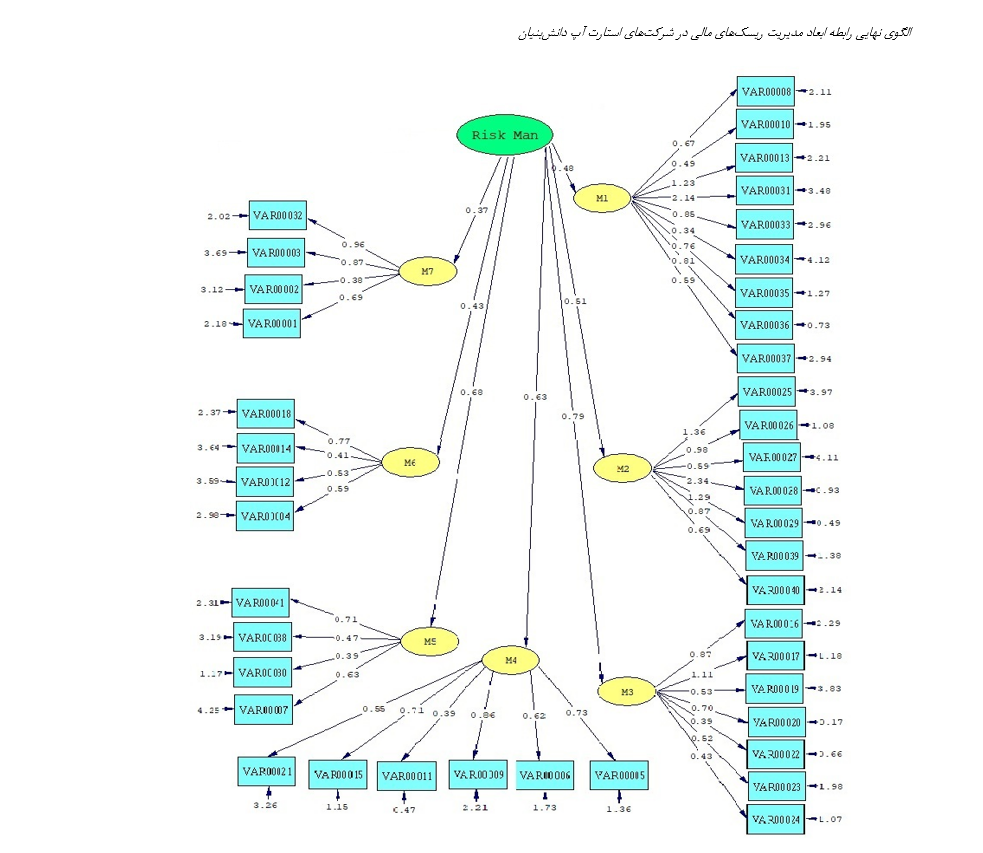

The aim of the present study is to examine the current status of financial risk management in knowledge-based startup companies of auditing firms located in Tehran provinces. The research method is descriptive-survey. The statistical population includes all senior and middle managers of auditing firms located in Tehran provinces, with a total of 112 individuals, of whom 87 were selected based on Morgan's table. In this study, simple random sampling was used to select the statistical samples. A questionnaire was utilized for data collection. The risk management questionnaire included causal factors (opportunity identification, financing), contextual conditions (material and moral support from the government, business expansion speed, competitors, profitability stabilization stage, environmental turbulence, technology, market), intervening factors (consulting, environmental uncertainties, financial risk hazards, research challenges, threats and weaknesses), marketing (financial strategies, inability to develop and implement financial strategies, weaknesses in executive management), and outcomes and feedbacks (fulfillment of social responsibilities, increased investor confidence, profitability effectiveness). These were identified as factors influencing the recognition of financial risk management in knowledge-based companies in Tehran province. To confirm the reliability and validity of the data collection tool, Cronbach's alpha was used, and expert opinions from management specialists were considered. Structural equation modeling tests revealed that: the inability to implement financial strategies and financial risk management in Tehran-based knowledge-based startups has a factor loading of 0.48; social and physical responsibility fulfillment and financial risk management in Tehran-based knowledge-based startups have a factor loading of 0.51; competitive strategy adoption and financial risk management in Tehran-based knowledge-based startups have a factor loading of 0.79; governmental financial and technical support and financial risk management in Tehran-based knowledge-based startups have a factor loading of 0.63; attracting investors in financial risk-taking projects and financial risk management in Tehran-based knowledge-based startups have a factor loading of 0.68; executive management weaknesses and financial risk management in Tehran-based knowledge-based startups have a factor loading of 0.43; and identifying entrepreneurial opportunities and financial risk management in Tehran-based knowledge-based startups have a factor loading of 0.37. These relationships are direct and statistically significant. In this study, the t-values for the financial risk management dimensions were estimated to range from 2.57 to 7.21, with the highest t-value corresponding to attracting investors in risk-taking financial projects (M5) and the lowest t-value corresponding to the inability to implement financial strategies (M1).

Downloads

References

Aghasi, S., Aghasi, E., & Biglari, S. (2016). Examining the Relationship Between Financial Risk Tolerance and Investor Characteristics (Financial Intelligence, Financial Management Skills, Wealth) Based on the Localized Donald Model: A Case Study of the Tehran Stock Exchange. Financial Knowledge of Securities Analysis (Financial Studies), 9(31), 21-33. https://sid.ir/paper/200254/fa

Agyapong, D., & Attram, A. (2019). Effect of Owner-Manager's Financial Literacy on the Performance of SMEs in the Cape Coast Metropolis in Ghana. Journal of Global Entrepreneurship Research, 9(67). https://doi.org/10.1186/s40497-019-0191-1

Cai, Y. (2024). Electronic Commerce Security and Risk Management: An Important Part of College Curriculum. Journal of Educational Theory and Management, 8(1), 18. https://doi.org/10.26549/jetm.v8i1.15646

Ferreira, J. A. B., Coelho, J., & Weersma, L. A. (2019). The Mediating Effect of Strategic Orientation, Innovation Capabilities, and Managerial Capabilities among Exploration and Exploitation, Competitive Advantage, and Firm's Performance. Accounting & Management, 64(1), 1-25. https://doi.org/10.22201/fca.24488410e.2019.1918

Florio, C., & Leoni, G. (2017). Enterprise Risk Management and Firm Performance: The Italian Case. The British Accounting Review, 49, 56-74. https://doi.org/10.1016/j.bar.2016.08.003

Hristov, I., Camilli, R., Chirico, A., & Mechelli, A. (2024). The integration between enterprise risk management and performance management system: Managerial analysis and conceptual model to support strategic decision-making process. Production Planning & Control, 35(8), 842-855. https://doi.org/10.1080/09537287.2022.2140086

Jafari Fesharki, P., Elyasi, M., & Touhidian, A. (2020). Determining Factors Affecting Financial Management and Related Risks in Active Startups in the Country. First International Conference on Challenges and New Solutions in Industrial Engineering, Management, and Accounting, Sari.

Karanja, E. (2017). Does the Hiring of Chief Risk Officers Align with the COSO/ISO Enterprise Risk Management Frameworks? International Journal of Accounting & Information Management. https://doi.org/10.1108/IJAIM-04-2016-0037

Olawale, O., Ajayi, F. A., Udeh, C. A., & Odejide, O. A. (2024). Risk management and HR practices in supply chains: Preparing for the Future. Magna Scientia Advanced Research and Reviews, 10(2), 238-255. https://doi.org/10.30574/msarr.2024.10.2.0065

Panjeshahi, M. (2020). Identifying and Prioritizing Critical Success Factors for Financial Startups (Case Study: Financial Startups in Tehran Province). Management and Accounting Studies Quarterly, 6(2), 1-145. http://uctjournals.com/farsi/archive/accounting/1399/summer/11.pdf

Pourahmadi, M. H., & Farsadamaneh, G. (2021). The Impact of Enterprise Risk Management on the Relationship Between External Financing and Earnings Management. Financial Accounting and Auditing Research Quarterly, 13(49), 73-95. https://journals.iau.ir/article_681884.html

Shad, M. K., Lai, F.-W., Lai Fatt, C., Klemeš, J. J., & Bokhari, A. (2019). Integrating Sustainability Reporting into Enterprise Risk Management and its Relationship with Business Performance: A Conceptual Framework. Journal of Cleaner Production. https://doi.org/10.1016/j.jclepro.2018.10.120

Shahrabi, B., Ashrafi, M., & Abbasi, E. (2021). Modeling Factors Affecting Startup Financing. Financial Management Strategy Quarterly, 7(2), 61-88. https://www.noormags.ir/view/en/articlepage/1494620/%D9%85%D8%AF%D9%84-%DB%8C%D8%A7%D8%A8%DB%8C-%D8%B9%D9%88%D8%A7%D9%85%D9%84-%D8%AA%D8%A7%D8%AB%DB%8C%D8%B1%DA%AF%D8%B0%D8%A7%D8%B1-%D8%A8%D8%B1-%D8%AA%D8%A7%D9%85%DB%8C%D9%86-%D9%85%D8%A7%D9%84%DB%8C-%D8%A7%D8%B3%D8%AA%D8%A7%D8%B1%D8%AA-%D8%A7%D9%BE-%D9%87%D8%A7-%DA%A9%D8%B3%D8%A8-%D9%88%DA%A9%D8%A7%D8%B1%D9%87%D8%A7%DB%8C-%D9%86%D9%88%D9%BE%D8%A7-%D8%A8%D8%A7-%D8%AA%DA%A9%D9%86%DB%8C%DA%A9-%D8%AF%DB%8C%D9%85%D8%AA%D9%84

Viganò, L., & Castellani, D. (2020). Financial Decisions and Risk Management of Low-Income Households in Disaster-Prone Areas: Evidence from the Portfolios of Ethiopian Farmers. International Journal of Disaster Risk Reduction. https://doi.org/10.1016/j.ijdrr.2020.101475

Wang, T.-S., Lin, Y.-M., Werner, E. M., & Chang, H. (2018). The Relationship between External Financing Activities and Earnings Management: Evidence from Enterprise Risk Management. International Review of Economics and Finance. https://doi.org/10.1016/j.iref.2018.04.003

Downloads

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2025 Journal of Technology in Entrepreneurship and Strategic Management (JTESM)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.