Providing a Model to Explain Factors Affecting the Improvement of Insurance Business Based on Digital Insurance with Emphasis on the Role of Extra-organizational Factors

Keywords:

Digital Insurance, Digital Governance, Business DevelopmentAbstract

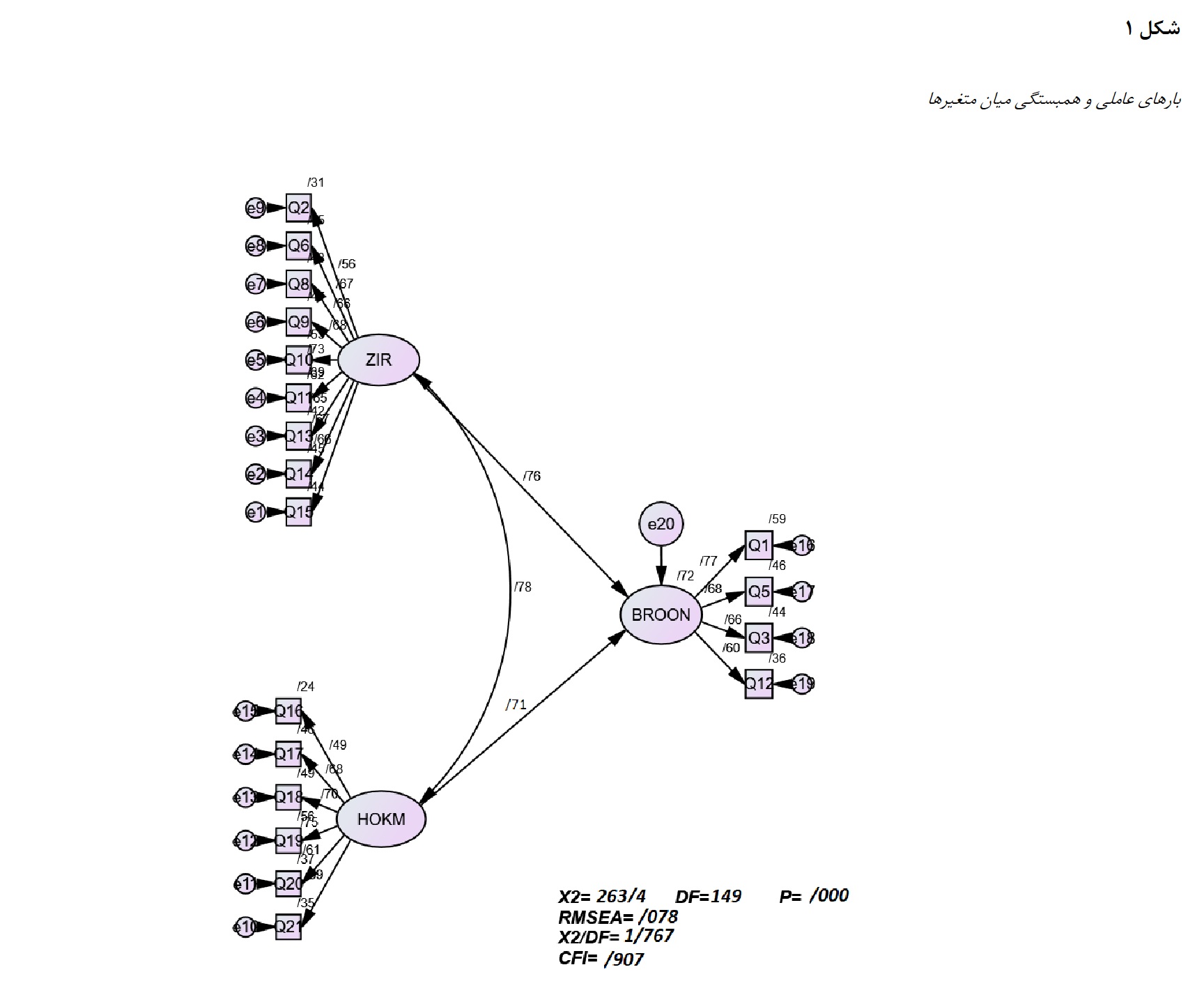

Today, managers of both traditional and startup businesses strive to reduce their organization's additional costs and provide better services to customers by adopting an appropriate approach and utilizing modern technologies such as pervasive connectivity, supply chain management, cloud computing, and big data. They also structure their organization based on the utilization of digital technologies and use them to create a new business model. This study aims to identify the factors affecting the improvement of the insurance business and focuses on the role of intra-organizational and extra-organizational factors in achieving digital insurance. The results from qualitative and quantitative analyses on data collected from insurance professionals and experts, using thematic analysis, exploratory factor analysis, confirmatory factor analysis, and structural equation modeling, led to the identification of factors and sub-scales. According to the findings of this research, insurance companies should consider the share and role of each intra-organizational and extra-organizational factor in achieving the approach of digital business development and improvement. Furthermore, according to the quantitative section of the research, the efforts of insurance companies in this path will only yield ideal results if the government creates the necessary digital capabilities for improving business in the insurance industry. This includes the formulation and revision of upstream laws, the establishment of national databases and communication infrastructures required by the country's insurance industry, and the development of necessary standards to provide a suitable environment for creating a digital ecosystem.

Downloads