The Moderating Pattern of the Life Cycle on the Relationship between Market Timing and Market Status on Stock Issuance Decisions with an Organic Approach Theory

Keywords:

Life Cycle, Market Timing Regime, Market Status, Stock Issuance, Organic ApproachAbstract

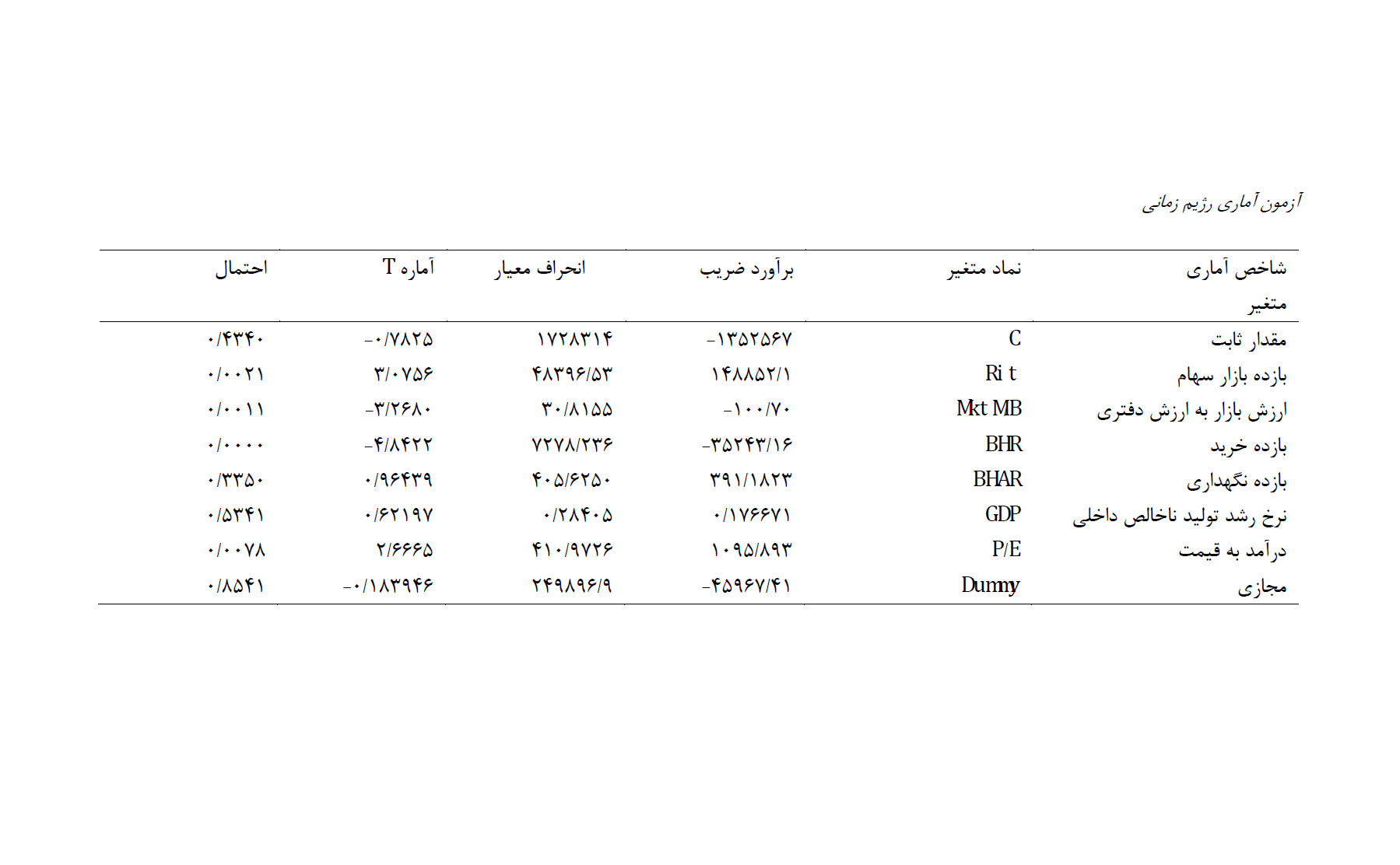

One of the features of today's markets is the focus on factors influencing stock issuance in competitive markets. The necessity of this matter lies in having comprehensive awareness of the company's position in financial markets and the surrounding environment affecting company performance. This research aims to examine the moderating pattern of the life cycle on the relationship between market timing and market status on stock issuance decisions, adopting an organic approach theory. For this purpose, 120 companies listed on the Tehran Stock Exchange were selected as the sample. To analyze the data, combined methods were used, and the regression model was estimated using Eviews7 software. The research findings indicate that there is a direct and significant relationship between the variables of stock market return, earnings to price ratio, and net cash flows minus paid dividends. Additionally, there is an inverse and significant relationship between the market value to book value ratio, buyback returns, and net cash flows minus paid dividends. However, there is no significant relationship between the variables of stock holding returns and the GDP growth rate and net cash flows minus paid dividends. The findings also show that companies in the maturity stage issue more stocks compared to other stages of the life cycle. This suggests that companies in the maturity stage have high levels of accessible capital, which can position them to attract more investments.

Downloads