Presentation of an Antifragility Model in Iranian Financial Organizations through Thematic Analysis

Keywords:

Antifragility, financial organizations, Thematic AnalysisAbstract

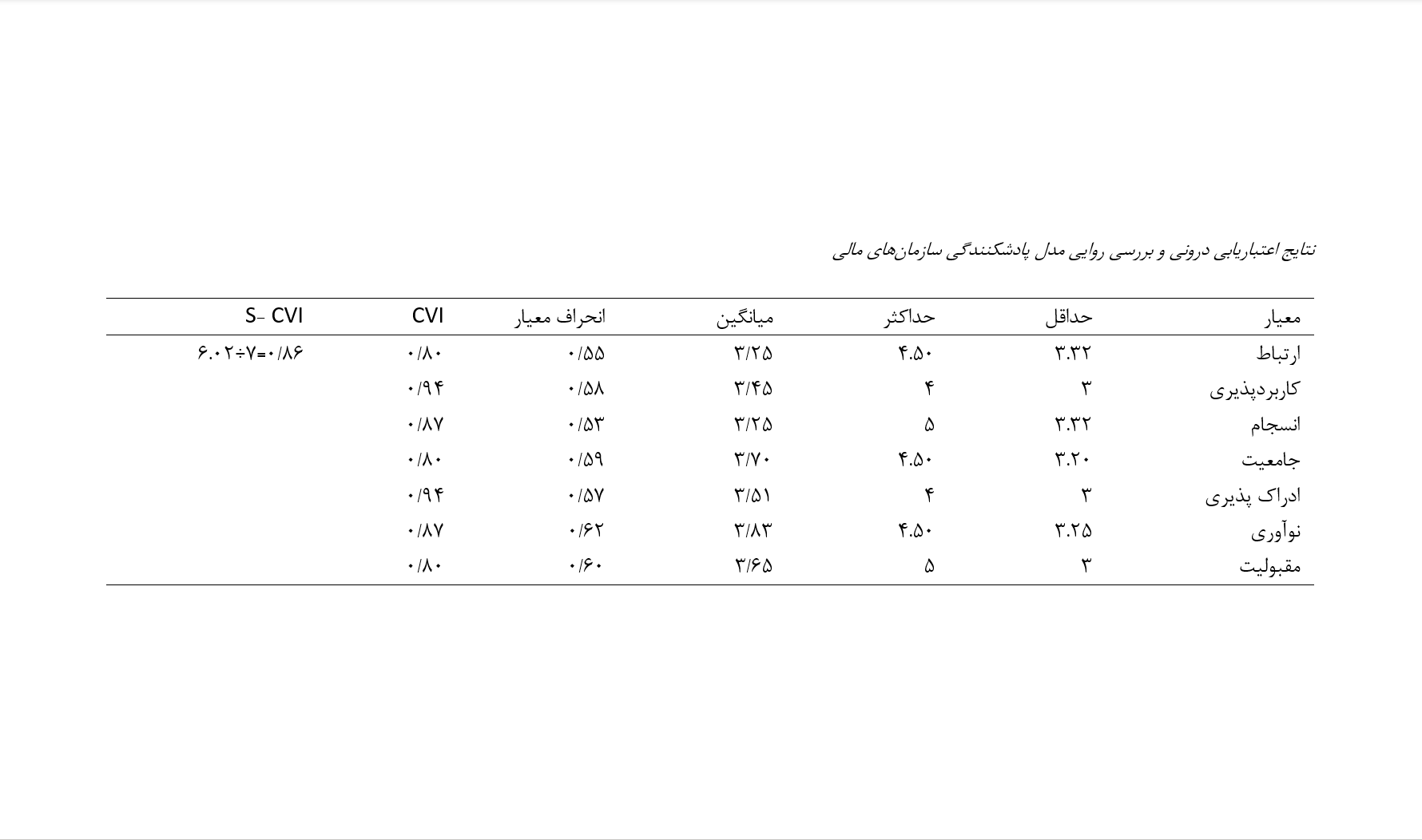

The present study aims to propose a qualitative antifragility model for Iranian financial organizations. The research methodology, in terms of data collection and execution, is qualitative. To design the model, thematic analysis was employed. Subsequently, the validity of the model's dimensions was determined using content validity indices (CVI, CVR, and S-CVI). The statistical population of the study consists of managers of financial organizations and university professors in Iran. The theoretical saturation was reached after conducting interviews with 10 experts in the field related to the research topic. The research findings led to the identification of 79 codes and 19 themes, categorized into four main groups: (1) Random and Environmental Category, which includes components such as flexibility, financial crisis, resilient performance, agility, and adaptability; (2) Financial Performance Category, including components like cost control, financial performance of institutions, central bank independence, inflation volatility, and cash flow management; (3) Managerial Category, comprising components such as risk management, economic growth improvement, capital management, financial policies, and government relations; and (4) Organizational Category, including components such as innovation and creativity, adaptability, resistance and confrontation, integration, and service empowerment. Additionally, the model's validity results indicate that it possesses a high level of content validity.

Downloads

References

Babovic, F., Babovic, V., & Mijic, A. (2018). Antifragility and the development of urban water infrastructure.

International journal of water resources development, 34(4), 499-509.

https://doi.org/10.1080/07900627.2017.1369866

Bayat, M., & Khansari, M. (2021). Resilience of Random Boolean Networks Using Network Entropy. First National

Conference on Complex Systems with a Focus on Network Science, Tehran.

Blečić, I., & Cecchini, A. (2017). On the antifragility of cities and of their buildings. City, Territory and Architecture, 4,

-11. https://doi.org/10.1186/s40410-017-0062-4

Creswell, J. W. (2012). Educational research: Planning, conducting, and evaluating quantitative and qualitative

research. Sage publications. https://repository.unmas.ac.id/medias/journal/EBK-00121.pdf

Creswell, J. W., & Creswell, J. D. (2005). Research design: Qualitative, quantitative, and mixed methods approaches.

Sage publications. https://www.ucg.ac.me/skladiste/blog_609332/objava_105202/fajlovi/Creswell.pdf

Danchin, A., Binder, P. M., & Noria, S. (2015). Antifragility and tinkering in biology (and in business) flexibility provides

an efficient epigenetic way to manage risk. Genes, 2(4), 998-1016. https://doi.org/10.3390/genes2040998

Größler, A. (2020). A managerial operationalization of antifragility and its consequences in supply chains. Systems

Research and Behavioral Science, 37(6), 896-905. https://doi.org/10.1002/sres.2759

Iqbal, N. (2016). Analysis of the Educational System from the Resilience Perspective. Electricity Era Journal, 3(5), Fall.

https://noavaryedu.oerp.ir/journal/editorial.board

Mohammadi, T., Shakeri, A., Taghavi, M., & Ahmadi, M. (2017). Elucidating the Concept, Dimensions, and Components

of Economic Resilience. Strategic Studies Journal of Basij, 20(75). https://www.bsrq.ir/article_80461.html?lang=fa

Momeni, S. M., Qasemi, A. R., Shahbazi, M., & Safari, A. (2021). Analysis of Resilience in the Service Supply Chain

in the Iranian Insurance Industry. Future Management Journal(67), 183-198.

https://www.sid.ir/fa/journal/SearchPaperlight.aspx?str=%D8%B2%D9%86%D8%AC%DB%8C%D8%B1%D9%

%20%D8%AA%D8%A7%D9%85%DB%8C%D9%86%20%D8%AE%D8%AF%D9%85%D8%A7%D8%AA

Munoz, A., Billsberry, J., & Ambrosini, V. (2022). Resilience, robustness, and antifragility: Towards an appreciation of

distinct organizational responses to adversity. International Journal of Management Reviews, 24(2), 181-187.

https://doi.org/10.1111/ijmr.12289

Qasemi, H. A. M., & Abbas. (2019). Estimating the Resilience Index of the Monetary and Financial Sector of the Iranian

Economy. Applied Economic Theories Journal, 6(3). https://www.sid.ir/paper/386094/fa

Rahimian Asal, M. M., & Maleki, M. H. (2023). A Model for Evaluating Supply Chain Resilience: A Case Study of

Daroupakhsh Distribution Company. Decision Making and Operations Research Journal, 8(1). https://www.journaldmor.ir/article_188158.html

Ramezani, J., & Camarinha-Matos, L. M. (2019). A collaborative approach to resilient and antifragile business

ecosystems.

Saidi Ravani, N., Mahdinejad, H., & Bayat, M. (2018). Spatial Distribution of Housing Poverty and Access to Welfare

Facilities in Shahriar City. International Conference on Security, Progress, and Sustainable Development of Border

Areas, Territorial Regions, and Metropolises: Solutions and Challenges with a Focus on Passive Defense and Crisis

Management, Tehran.

Taleb, N. N. (2012). Antifragile: Things That Gain from Disorder (Translated by Mina Safari, Edited by Behnam Fallah

ed.). Novin Tose'e Publications. http://kgt.bme.hu/files/BMEGT30M400/Taleb_Antifragile__2012.pdf

Taleb, N. N. (2013). 'Antifragility' as a mathematical idea. Nature, 494(7438), 430-430. https://doi.org/10.1038/494430e

Downloads

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2024 Journal of Technology in Entrepreneurship and Strategic Management (JTESM)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.