Presentation of an Antifragility Model in Iranian Financial Organizations through Thematic Analysis

Keywords:

Antifragility, financial organizations, Thematic AnalysisAbstract

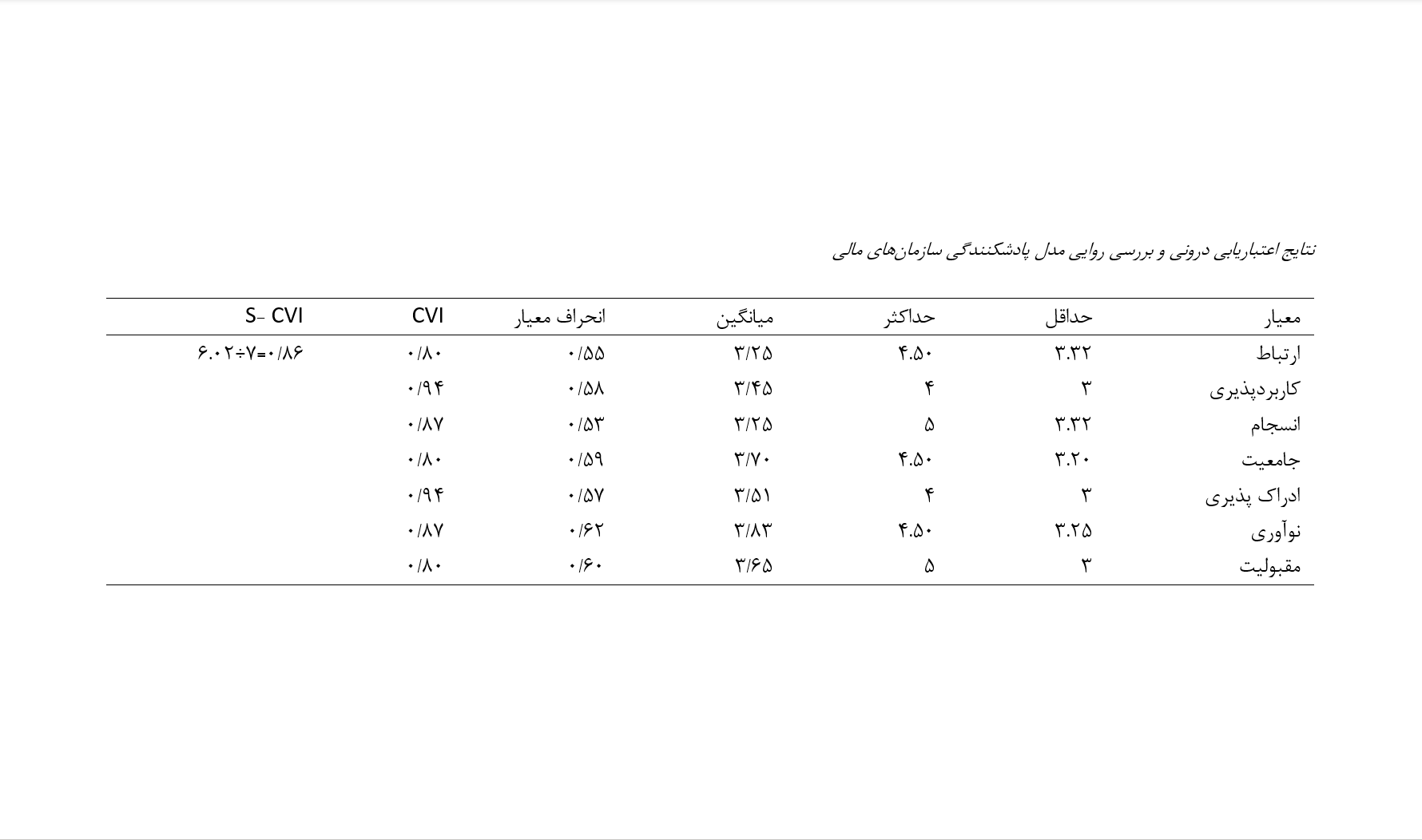

The present study aims to propose a qualitative antifragility model for Iranian financial organizations. The research methodology, in terms of data collection and execution, is qualitative. To design the model, thematic analysis was employed. Subsequently, the validity of the model's dimensions was determined using content validity indices (CVI, CVR, and S-CVI). The statistical population of the study consists of managers of financial organizations and university professors in Iran. The theoretical saturation was reached after conducting interviews with 10 experts in the field related to the research topic. The research findings led to the identification of 79 codes and 19 themes, categorized into four main groups: (1) Random and Environmental Category, which includes components such as flexibility, financial crisis, resilient performance, agility, and adaptability; (2) Financial Performance Category, including components like cost control, financial performance of institutions, central bank independence, inflation volatility, and cash flow management; (3) Managerial Category, comprising components such as risk management, economic growth improvement, capital management, financial policies, and government relations; and (4) Organizational Category, including components such as innovation and creativity, adaptability, resistance and confrontation, integration, and service empowerment. Additionally, the model's validity results indicate that it possesses a high level of content validity.

Downloads