Determining the Financial Solvency Level of Insurance Companies by Insurance Branches

Keywords:

Insurance solvency, solvency margin ratio , regulatory coefficients , actuarial risk assessment , financial stability , insurance risk management , capital adequacy , insurance branches , financial performanceAbstract

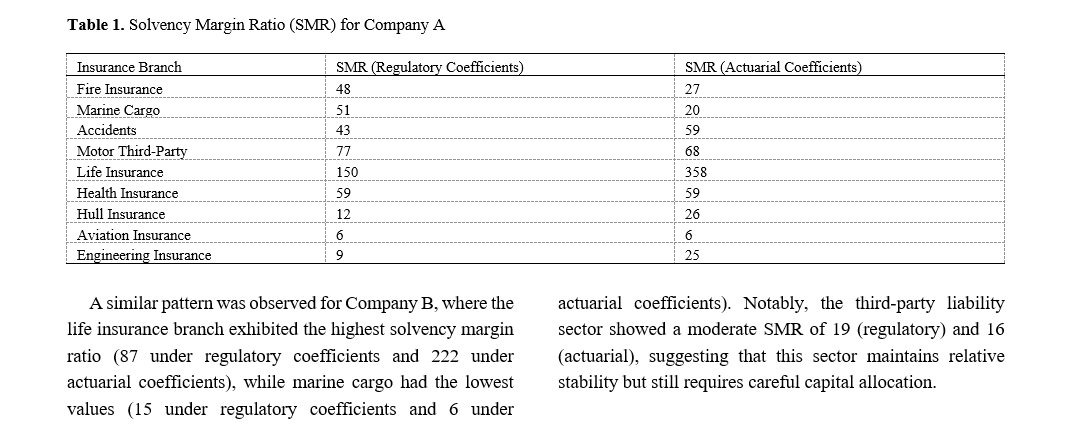

This study aims to assess the financial solvency levels of insurance companies across different insurance branches by comparing solvency margin ratios (SMR) calculated using regulatory coefficients and actuarial risk assessments. The study employs a quantitative research design, analyzing the financial solvency of eight major insurance companies operating across multiple branches, including life, health, property, liability, aviation, and marine insurance. Data were collected from publicly available financial reports, solvency disclosures, and actuarial evaluations, following the solvency assessment guidelines outlined in regulatory frameworks such as Solvency I and Solvency II. The solvency margin ratio was calculated using the formula SMR = Available Capital ÷ Required Capital, with comparative analysis conducted to evaluate differences between regulatory and actuarial assessments across insurance branches. Descriptive analysis, ratio comparisons, and sensitivity analysis were employed to interpret the results. The results indicate significant discrepancies between regulatory and actuarial solvency assessments, with life insurance demonstrating the highest solvency ratios and aviation and marine insurance exhibiting the lowest solvency levels. The findings suggest that regulatory solvency assessments may underestimate financial risks in high-risk branches, whereas actuarial assessments provide a more comprehensive risk-sensitive evaluation. Companies with diversified portfolios and strong capital reserves generally demonstrated higher solvency ratios, emphasizing the importance of risk management and capital adequacy strategies in maintaining financial stability. The study highlights the necessity for a more refined regulatory framework that aligns with actuarial risk assessments to ensure accurate solvency evaluations and financial resilience. Insurance companies should integrate both regulatory and actuarial solvency models to enhance financial risk management, particularly in high-risk branches such as aviation and marine insurance, to strengthen financial sustainability.

References

V. Bondarenko and Н. О. Пустова, "Insurance Functions as an Object of Financial and Legal Regulation," Соціально-Правові Студії, vol. 13, no. 3, pp. 163-168, 2021, doi: 10.32518/2617-4162-2021-3-163-168.

S. I. Bukowski and M. Lament, "Market Structure and Financial Effectiveness of Life Insurance Companies," European Research Studies Journal, vol. XXIV, no. Issue 2B, pp. 502-514, 2021, doi: 10.35808/ersj/2248.

C. N. Muriungi and D. A. O. Jagongo, "Financial Inclusion and Financial Performance of Insurance Companies Listed in the Nairobi Stock Exchange," strategicjournals.com, vol. 8, no. 4, 2021, doi: 10.61426/sjbcm.v8i4.2096.

O. Handayani, M. Sari, A. Nopiazinda, R. Anugrah, and S. U. Rahayu, "Pentingnya Kualitas Pelayanan Dalam Anuitas Dengan Tinjauan Financial Highlight Asuransi Di PT. Asuransi Umum Bumiputera Muda 1967 Cabang Medan," Jurnal Emt Kita, vol. 8, no. 1, pp. 421-430, 2024, doi: 10.35870/emt.v8i1.2097.

N. D. Stelmashenko, "Industry Features of Financial Analysis of Insurance Companies," Ekonomika I Upravlenie Problemy Resheniya, vol. 2, no. 9, pp. 60-65, 2020, doi: 10.36871/ek.up.p.r.2020.09.02.012.

Y. Nesenіuk, I. Zhuravel, and V. Yakovenko, "Management of Financial Resources of Banking Institutions and Insurance Companies: Integration Aspect," Problems of Systemic Approach in the Economy, no. 2(88), 2022, doi: 10.32782/2520-2200/2022-2-12.

А. А. Тедеев, "State Insurance in the Soviet Legal Doctrine," Финансы И Управление, no. 1, pp. 72-78, 2021, doi: 10.25136/2409-7802.2021.1.35126.

Z. Hizia, "The Relevance of Financial Analysis in Performance Assessment: The Case of an Algerian Insurance Company," Socioeconomic Challenges, vol. 7, no. 4, pp. 199-210, 2023, doi: 10.61093/sec.7(4).199-210.2023.

K. Morara and A. B. Sibindi, "Determinants of Financial Performance of Insurance Companies: Empirical Evidence Using Kenyan Data," Journal of Risk and Financial Management, vol. 14, no. 12, p. 566, 2021, doi: 10.3390/jrfm14120566.

P. S. Kasoga and A. G. Tegambwage, "Insurance Fraud and Financial Performance," pp. 236-258, 2023, doi: 10.4018/978-1-6684-5007-9.ch010.

A. V. Novikov, "Assessment of the Possibility of Forming a Regional Financial Center in a Federal Subject of the Russian Federation," Sibirskaya Finansovaya Shkola, no. 1, pp. 42-55, 2022, doi: 10.34020/1993-4386--2022-1-42-55.

D. Liu, Y. Xie, M. Hafeez, and A. Usman, "The Trade-Off Between Economic Performance and Environmental Quality: Does Financial Inclusion Asymmetrically Matter for Emerging Asian Economies?," 2021, doi: 10.21203/rs.3.rs-834441/v1.

О. Zharikova and K. Cherkesenko, "Bankinsurance: New Challenges and Development Prospects in Ukraine," Bioeconomics and Agrarian Business, vol. 11, no. 3, pp. 16-36, 2021, doi: 10.31548/bioeconomy2020.03.016.

P. Muthulakshmi and A. Muthumoni, "Determinants of Financial Performance – A Comparative Analysis of Public Sector Non-Life Insurers in India," Sdmimd Journal of Management, pp. 25-33, 2023, doi: 10.18311/sdmimd/2023/32475.

T. Nadirra, F. S. Bz, and M. A. Djalil, "Comparing Performance Using Balance Scorecard Method: Evidence of Conventional vs Shariah Insurance Firms," Journal of Accounting Research Organization and Economics, vol. 3, no. 3, pp. 273-291, 2020, doi: 10.24815/jaroe.v3i3.16926.

N. Vojvodić-Miljković and M. Stojković, "Interdependence of Insurance Need and Development Insurance Markets," International Review, no. 3-4, pp. 104-108, 2022, doi: 10.5937/intrev2204110v.

R. Stempel, "Performance of the Polish Insurance Sector in the Second Decade of the 21st Century," Olsztyn Economic Journal, vol. 15, no. 3, pp. 251-264, 2020, doi: 10.31648/oej.6542.

İ. Yıldırım, "The Impact of Insurance Sector Premium Production on Economic Development," Cumhuriyet Üniversitesi İktisadi Ve İdari Bilimler Dergisi, vol. 23, no. 2, pp. 492-501, 2022, doi: 10.37880/cumuiibf.1021397.

D. A. N. Marpaung, N. A. B. Rahmani, and L. Syafina, "Analisis Pengaruh Etika Personal Selling Terhadap Kepuasan Nasabah Asuransi Jiwa Pt. Sunlife Financial Cabang Medan," Jeber, vol. 1, no. 2, pp. 06-14, 2024, doi: 10.69714/p8fza346.

N. N. Nersisyan, "Livestock Insurance Prospects in the Republic of Armenia," Messenger of Armenian State University of Economics, pp. 80-92, 2024, doi: 10.52174/1829-0280_2024.2-80.